1899 Establishment and operation of the “Nicosia Savings Bank”.

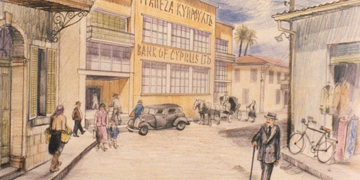

1912 Nicosia Savings Bank renamed “Bank of Cyprus” and recognised as a public company.

1943 Bank of Cyprus merges with banking institutions in other towns and expands throughout Cyprus. Ancient Cyprus coin bearing the inscription “Koinon Kyprion” (common to all Cypriots) adopted as the Bank’s emblem.

1944 Establishment of Mortgage Bank of Cyprus.

1951 Establishment of General Insurance of Cyprus.

1955 Establishment of Bank of Cyprus (London).

1964 Establishment of Bank of Cyprus Finance Corporation.

1973 Reorganisation of the Group, with the establishment of Bank of Cyprus (Holdings) to take over the shares of Bank of Cyprus and all its subsidiaries.

1980 Acquisition of Chartered Bank in Cyprus.

1982 Establishment of The Cyprus Investment and Securities Corporation (CISCO).

1983 Acquisition of Kermia by the Group. Representative Offices opened in Greece and Australia.

1984 Establishment of the Bank of Cyprus Cultural Foundation.

1989 Establishment of the life insurance company EuroLife.

1991 Bank of Cyprus opens its first branch in Greece. Establishment of the Bank of Cyprus Medical Foundation.

1992 Establishment of Bank of Cyprus Factors.

1993 Establishment of ABC Factors, the first factoring company in Greece. Karmazi Properties & Investments acquired and renamed Kermia Properties & Investments.

1995 Representative Office opened in South Africa. Museum of the History of Cypriot Coinage founded.

1996 The first Greek-speaking offshore bank, Bank of Cyprus (Channel Islands) established in Guernsey, Channel Islands. Representative Office opened in Canada (Toronto).

1997 Kyprou Leasing established in Greece. Opening of the first branch of Bank of Cyprus in the United Kingdom.

1998 Representative Office opened in Russia (Moscow). Kyprou Mutual Fund Management Company (AEDAK) established in Greece. Opening of the Bank of Cyprus Oncology Centre.

1999 Group restructuring, with shares of Bank of Cyprus (Holdings) being replaced by Bank of Cyprus shares. Representative Office opened in Bucharest. “Oikade” educational programme launched.

2000 Listing of the Group’s share on the Athens Exchange. Establishment of Bank of Cyprus Australia and operation of its first branches. Electronic banking introduced to provide alternative service channels (internet, telephone, WAP).

2001 Kyprou Asfalistiki, a branch of General Insurance of Cyprus, and Kyprou Zois a branch of EuroLife, open in Greece. Greek company Victory Securities acquired and renamed Kyprou Securities. Sale of 50% stake in ABC Factors to Alpha Bank.

2002 Bank of Cyprus Factors starts providing factoring services in Greece.

2004 Merger of Bank of Cyprus (London) and the UK branch of Bank of Cyprus.

2005 Merger of the operations of Bank of Cyprus Factors and Bank of Cyprus Finance Corporation with Bank of Cyprus. 100th branch opened in Greece.

2006 Commencement of leasing operations in Romania through the establishment of the leasing subsidiary Cyprus Leasing (Romania).

2007 Banking services commenced in Romania and Russia.

2008 Commencement of banking services in Ukraine through the acquisition of AvtoZAZbank. Acquisition of 80% of Uniastrum Bank in Russia and expansion into the retail banking sector of the local market.

2010 Commencement of the establishment of a Representative Office in India and a banking unit in the Emirate of Dubai.

2011 Sale of Bank of Cyprus Australia Ltd.

2012 Applied to the Republic of Cyprus for capital support.

2013 Following the decisions of the Eurogroup meeting on 25 March 2013 and the decrees issued by the Central Bank of Cyprus, the Bank was under Resolution from 25 March 2013 until 30 July 2013, a period during which it was recapitalised and restructured. The recapitalisation was implemented via the bail-in of depositors, through the conversion of 47,5% of uninsured deposits into equity. In addition, the holders of ordinary shares and debt securities issued by the Group as of 29 March 2013 have contributed to the recapitalisation through the absorption of losses.

During the period under Resolution, the Group

- disposed loans, fixed assets and deposits of its Greek operations to Piraeus Bank S.A.;

- acquired assets and liabilities of the Cypriot operations of Cyprus Popular Bank Ltd (Laiki Bank, the second largest bank in Cyprus);

- acquired the operations of the Laiki Bank’s Branch operations in the United Kingdom; and

- disposed the majority of deposits and retail loans of the Bank of Cyprus branch operation in Romania.